(Miles Franklin Media) – The global financial landscape is on the cusp of a profound transformation, with the U.S. dollar's long-standing dominance facing unprecedented challenges from both internal vulnerabilities and external pressures, according to Andy Schectman, Founder and CEO of Miles Franklin Precious Metals.

In the first episode of ‘The Real Story with Michelle Makori,’ Schectman said he believes a covert gold accumulation program is underway, signaling that the U.S. could be positioning itself for a dramatic shift in global monetary policy.

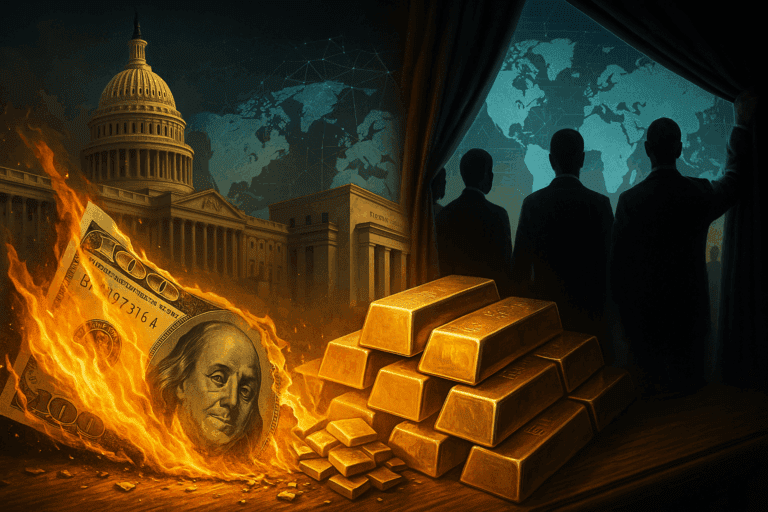

“I do think that gold is being brought back into the country and is quietly being reintroduced to the system to back the U.S. Treasury market to lower borrowing costs,” he told Michelle Makori, Editor-in-Chief and President of Miles Franklin Media. “They’re letting the dollar die on purpose.”

Schectman’s core thesis is that the United States is quietly preparing for a monetary reset by bringing gold back into the financial system. This would not be a return to a classical gold standard, but a strategic move to restore trust and support the Treasury market as global demand for U.S. debt declines.

He believes this is a defensive response to the BRICS nations, who are aggressively de-dollarizing and integrating gold into their trade and monetary systems. This includes bilateral trade in local currencies, the accumulation of physical gold, the expansion of the Shanghai Gold Exchange, and the development of non-Western gold settlement networks.

According to Schectman, the U.S. may be preparing to revalue its official gold reserves, which are still marked at $42.22 per ounce on the books, and use that gold as a backstop for Treasuries or even introduce a gold-linked instrument to attract global buyers.

He argues that while this may help prop up the U.S. bond market, it could come at the cost of the dollar's supremacy. The U.S. would be forced to sacrifice its ability to issue limitless fiat in exchange for restoring credibility in a world that is rapidly moving toward a multipolar monetary system centered around real assets.

“Since November, we've become a net importer – close to a $100 billion dollars worth of gold has come into this country, just into the Comex that we know of. I've been doing this for 36 years, this has never happened,” Schectman said. “If we don't do something unconventional like this, then it's going to be not just a hard landing, it's going to be a complete and total reversal of everything. That's when you get the reset.”

The United States is grappling with an exploding national debt, now past $37 trillion, exceeding 120% of GDP, with interest payments alone projected to surpass a trillion dollars a year. Schectman adds that this internal strain is compounded by external threats from the BRICS nations, which President Trump states are "setting up to destroy the dollar."

BRICS nations, viewing tariffs as sanctions, are actively seeking to reduce U.S. dollar dependence through increased trade in local currencies and by building a global settlement system that cuts the dollar out of the equation, Schectman pointed out.

“The global south is trying to break free from the Western hegemony, largely because of the mismanagement of our monetary system, our fiscal irresponsibility in the weaponization of the Treasury market,” he said.

At the same time, BRICS members are demanding major reforms at the IMF, including changes to voting power and the role of gold in reserve asset valuation. This comes as the IMF continues to ban gold-linked currencies, a legacy of decisions made in 1978.

“When the countries stockpiling gold are also calling to reform the IMF – it’s worth paying attention,” Makori said.

In this episode, Makori and Schectman unpack:

How close are we to a deliberate, engineered de-dollarization? Watch the video above for more of Schectman’s insights!